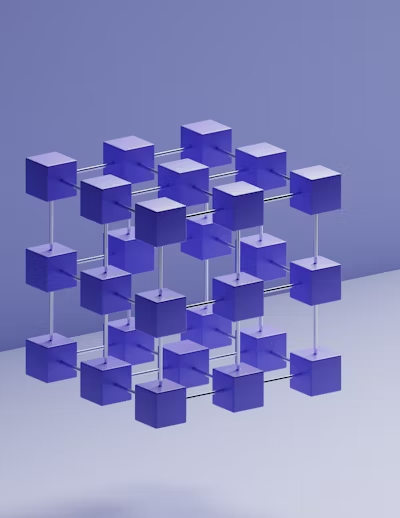

The answer is simple, Blockchain. Unlike traditional financial systems, DeFi operates independently of centralized authorities like banks. More than that, it uses blockchain-based smart contracts to process transactions and for banking services. DeFi facilitates the process of lending, borrowing, and trading digital assets without intermediation through decentralized marketplaces and funding pools.

In the beginning, DeFi was limited to only lending and borrowing, but now it covers all kinds of financial services ranging from just a simple loan-deposits service, fancy crypto-lending, yield farming, or complete digital asset management which replicates nearly everything like our traditional banking system (banks) do. The result at which this is evolving shows DeFi has the potential to shape banking of the future.

Core Components of DeFi

DeFi’s first big innovation is yield farming which enables the user to receive awards through gifting money to DeFi sites. Depositing their money in a liquidity pool means that users can get interest or other tokens as rewards.

Next is Staking. Staking involves the ability of cryptocurrencies to fund a network’s operation. In exchange, users get winning prizes or interest. Staking not only allows a network to be safeguarded but that the owners of staked tokens will also earn money.

We need liquidity pools for DeFi. It owns capital that helps in trading on decentralized exchanges commonly referred to as DEX. Users vest their coins in these pools and they get paid commissions on each transaction. It does so by assisting with DeFi trading and guaranteeing volume in this process.

Combined, yield farming, staking, and liquidity pools are changing how money is used and spent in the DeFi space. These innovations provide the possibilities for creating and accumulating assets through open financial systems.

Impact on Traditional Finance

DeFi is revolutionizing the banking industry by providing decentralized solutions. It is also important to understand that, unlike traditional banking that has integration with central repositories, DeFi operates by using blockchain. The comparison with traditional banking reveals significant discrepancies. Other benefits that DeFi systems provide include better financial access and lower fees. Users can sell, give, and borrow without having to involve banks at any time.

Leveraging traditional funds usually entails many stages and high expenses. DeFi has advantages such as enhanced convenience, accessibility, and freedom from a centralized source. DeFi services are available globally and do not require third parties. This can result in cost reduction and faster completion of activities within organizations as well. At the same time, DeFi is still a relatively young market, and it is unstable and high-risk compared to traditional finance. Other factors such as the security risks and the legal challenges also pose a stability threat to it than the traditional established banks.

Risks and Challenges

There are various risks and challenges that DeFi deals with. First of all, there is an issue of security. There is a high chance that smart contacts contain bugs hence prone to hacks resulting in financial losses. Special care should be taken to maximize the audits of these contracts and make them safe.

Regulatory challenges are also a task for DeFi. Every now and then, Governments are still learning how to exercise powers of regulating such decentralized banking. DeFi might be affected by this turmoil, also investors may face certain risks as a result. It also highlights new directions for the further development of decentralized finance, based on the ability to work in legal environments.

The Future of DeFi

All in all, the prospects of DeFi are rather promising with several new trends already on the horizon. One of them is the interaction with centralized financial systems based on banks, which may expand the use of DeFi. Another is the introduction of better interface designs to allow more users to access decentralized finance applications.

Other possible progress may be enhancements in the scalability and security of the concept behind Bitcoin. Such innovations like layer 2 solutions could improve the pace of transactions and lower costs. Thus, with the development of DeFi, there can be even more opportunities to develop financially in the future.

Conclusion

DeFi is changing how we use and handle money. Its innovations offer new ways to earn and spend, but risks and regulatory problems must be handled. The future of DeFi holds exciting possibilities, with new trends and possible developments that could reshape finance.