Nigeria is a pretty important country in Africa, being the most populated country on the continent and among its top 5 economies. The Nigerian population of over 200 million people makes it a big market for local and foreign entities. The concept of cryptocurrency which started in 2009 with the launch of the Bitcoin white paper is still relatively new compared to other financial models.

Credible sources pegged the number of global crypto users at 400 million. This means that cryptocurrency adoption is still less than 6% of the total world population.

Data on the 400 million crypto users on the globe revealed the countries that are leading the charge in terms of crypto adoption and the reason behind the high crypto adoption in these countries.

According to a 2024 Chainalysis report on Global crypto adoption, Nigeria, a West African country has the second-highest rate of crypto adoption in the world.

The first 5 countries are India, Nigeria, Indonesia, the United States, and Vietnam.

Nigeria was the only African country in the top 20 list cementing its position as the continent’s leader in cryptocurrency. We are going to take a closer look at Nigeria’s cryptocurrency adoption focusing on the various assets. the reason behind its high adoption rate and the challenges facing the industry.

The Metrics of Nigeria’s Crypto Adoption

Nigeria as discussed above is the country with the second-highest crypto adoption in the world and the leading crypto economy in the African continent. The African continent has made the news for its fast-growing rate of crypto adoption. Nigeria’s high cryptocurrency adoption rate tallies with its crypto transaction volume which continues to grow.

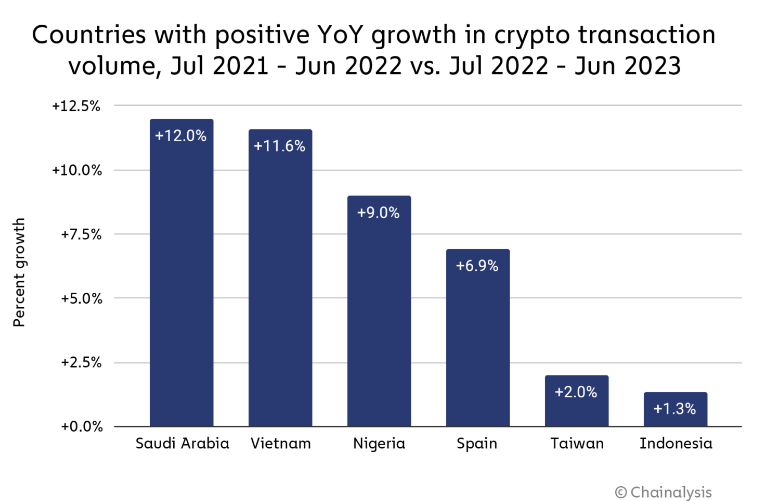

A 2023 study by Chainalysis revealed that Nigeria’s crypto transaction volume has consistently grown year on year at a rate of 9.0%. Nigeria’s 9% year-on-year growth places it third on the list of the Top 6 countries with the highest growth in crypto transaction volume.

Nigeria’s high crypto transaction rate points to the fact that crypto is used in Nigeria as a store of value and as a solution to the free fall of the Nigerian Naira. Cryptocurrency in Nigeria is heavily patronized by its young demographic who are more open to new ideas and are increasingly becoming active participants in the global market.

Other economic factors which include two recessions since 2016, the collapse of oil prices, high unemployment, and a record-high inflation rate have directly or indirectly contributed to the popularity of crypto assets in the country leading to the consistent growth in transaction volume.

Bitcoin and Stablecoin Leading in Nigerian Crypto Exchanges

The flagship cryptocurrency Bitcoin and stable coins like USDT and USDC are the leading crypto assets in terms of transaction volume on Nigerian crypto exchanges.

Chainalysis 2023 report traced a corresponding rise in interest in these two crypto assets as the naira value decreased meaning that most Nigerians are using these crypto assets to escape the devaluation of the Naira.

Stablecoins which are crypto assets pegged to the value of the US dollar have become a must-have for most Nigerians and are now convenient alternatives to having a domiciliary account.

Most young Nigerians who work remotely with foreign companies receive their salaries in USDT or USDC adding to the popularity of the stable coin and its high transaction volume in Nigerian exchanges.

Besides the high interest in Bitcoin and stablecoins, Meme coins are also up there in terms of interest and transaction volume. Meme coin trading is quite popular in the Nigerian Web 3 space as most Nigerians are keenly interested in the next possible 10X or 100X memecoin.

Challenges

Despite the high cryptocurrency adoption in Nigeria, the sector still faces significant challenges affecting both crypto users and entities as well. A bulk of the challenge posed to the sector stems from a lack of a clear regulatory framework from Nigerian authorities.

The Nigerian cryptocurrency sector experienced a three-pronged crackdown led by the Nigerian Securities and Exchange Commission (SEC), The Central Bank of Nigeria (CBN), and the Economic and Financial Crimes Commission (EFCC).

The crackdown led to top crypto exchanges like Binance, Kucoin, and OKX shutting down parts of their operation in the country and delisting Naira from their platform.

The Absence of regulatory clarity makes it difficult for investors who are looking to capitalize on Nigeria’s huge crypto market to do that and also muddies the water for the Nigerian crypto user who is in bad need of credible infrastructure.

The Nigerian SEC under Emomotimi Agama has made credible steps to resolve the challenge of regulatory clarity. The recent issue of licenses to two Nigerian crypto exchanges Quidax and Busha is good news for the industry and paints hope for a promising future.

Nigeria’s high cryptocurrency adoption makes it an important player in the global crypto market. Nigerian crypto founders can leverage this simple statistic to build products targeted at the Nigerian market and beat foreign entities using home advantage.

As global cryptocurrency adoption continues to grow, Nigeria is expected to become a bigger part of the conversation driving crypto adoption in Africa while attracting the best projects and products in the global crypto industry.