Chainlink Staking is everything you need to know to unlock the full potential of decentralized finance. Staking cryptocurrencies entails locking up a portion of one’s holdings for a defined length of time in exchange for future rewards. As a result, Chainlink staking functions as both a security and incentive system within the Chainlink network. The major goal is to strengthen network security by compelling participants to stake their LINK tokens, the network’s native coin.

Why Stake LINK?

Chainlink Staking is a key effort of Chainlink Economics 2.0, allowing LINK token holders and node operators to earn benefits for contributing to the cryptoeconomic security of Oracle services. With the Chainlink Network enabling over 12 trillion dollars in transaction value since the start of 2022, it is critical that network security scales over time to match the increasing quantity of value safeguarded within Chainlinked apps. The earlier version of Chainlink Staking (v0.1) was released in December 2022, marking a significant milestone in Chainlink’s new age of long-term growth and security. While v0.1 was the initial Staking software, v0.2 has been redesigned to be fully modular, expandable, and upgradeable.

How are Chainlink staking rewards generated?

The following shows the staking rewards earned on LINK via network emissions in Chainlink Staking v0.1.

Benefits for Chainlink Node Operators

Node Operator Stakers can make about 7% in LINK annually. This is broken out as a baseline return rate of 5% per year in LINK against their pledged stake, plus additional incentives from the 5% delegation fee deducted from Community Stakers’ payments.

Rewards for Community Stakers

Community stakeholders should expect an effective annualised return rate of 4.75% in LINK for staking on the network. This includes a 5% baseline reward rate, with Node Operators receiving a 5% piece of community stakeholder funds as delegation fees.

Alerting Rewards

As part of v0.1, if there hasn’t been a new oracle report on ETH/USD in over three hours, stakeholders on the Ethereum mainnet can raise an alarm. If a Node Operator Staker sends out a valid alert within the Priority Period, they can earn 7000 LINK. After this period, every staker who raises a legitimate alert can earn 20% of the staked LINK, up to a maximum of 7,000 LINK.

How To Stake Chainlink Step-By-Step

Staking LINK can now be done after you have chosen the best staking platform for yourself. You participate in the decentralized network by locking your LINK tokens within the security of the platform you mas provides a passive income to its users through LINK rewards.

Step 1: Sign Up For A Staking Platform.

As soon as you have conducted your research and chosen the appropriate staking platform you will have to register in order to create an account and start staggering your LINK Tokens. The process to create an account is very simple and does not involve a lot of processes. You will be required to provide you basic personal details such as your names, email address and password. Once you have signed up, you will be able to fund your account with LINK tokens.

Step 2: Deposit LINK into the platform.

In most cases, the information provided during registration is usually sufficient to set up the account without the need for an email verification link. The LINKs cannot be earned until you make a transfer of your NRV coins to the staking platform. This simple method involves moving your LINK from an external wallet that you use to the platform internal wallet. When you make the deposit of LINK tokens into the platform, they will put them into cold storage and prepare them to be used in the administrative works of the staking function.

Step 3: Set up your staking preferences.

Once you have enrolled and deposited your LINK tokens, you will then have to set up your staking options. This is an essential step of staking since it gives you flexibility over the degree of your commitment and the degree of return.

The first decision concerns the amount of LINK that you wish to stake. This will determine your share in the security of the network as well as in any assets those targeted assets will yield. As a general rule, the bigger the amount you are willing to stake the bigger number of LINK you are bound to obtain and come in handy. Nevertheless, it is essential to understand that staking more amount of LINK also results in a longer duration of your funds being locked in the system.

The second choice to be specified is the length of the staking period. This is the duration which your tokens will be unable to bear fruit and will be earning bonuses instead. This range is usually between 30 and 90 days. The longer the time duration for the staking is defined, the better the profit earned. However, you shall not be able to access your tokens during the entire staking time.

Step 4: Start The Staking Process

After you’ve validated your decision, the staking procedure will commence. Your LINK tokens will be locked up and start collecting rewards. The amount of rewards you get will be determined by your staking amount, staking duration, and current market conditions.

Since most Africans know Metamask, let’s explain staking especially on Metamask.

Step-by-Step Guide for Staking Chainlink with Metamask

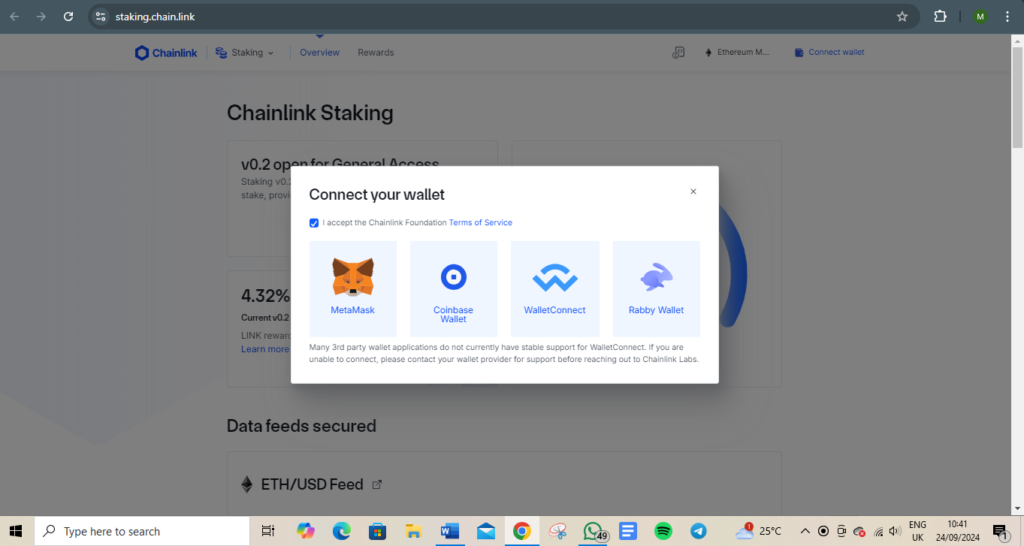

- Go to the Chainlink Staking web page.

- Select the “Connect Wallet” option at the top-right corner of the web page. Select Metamask.

- Pick a wallet account. If you have just one account, you should choose the single option to connect your wallets. However, if you have more than one Metamask account, you should click on the LINK token-enabled wallet address.

- Select “Next” to connect the self-custodial wallet to the staking website and “Connect” to connect the account for staking on Chainlink. This will take you to the staking web page, where you will see the associated wallet address in the top-right corner.

- Next, pick the quantity of LINK to stake. Note: You cannot stake more tokens than are available in your wallet.

- Selecting the “Stake LINK” option. You will receive a prompt that includes the terms of service. Makes sure to read the terms and conditions carefully. If you are okay with it click “Accept and continue” to proceed.

- The Metamask wallet plugin will launch and ask for your permission to confirm the transaction. Check the amount of ETH you need to pay for network transaction fees.

- Click “confirm” and wait for confirmation, which will rely on petrol costs and your network activity. When you see a page with the “Transaction complete” notice, you can view the transaction on Etherscan.

Is Chainlink Staking Safe?

Chainlink, one of the largest decentralised oracle networks, takes several safeguards to ensure the protocol’s security. Regardless, recognising the risks and issues of Chainlink staking is an important step towards making safer crypto staking decisions. Chainlink relies on the Ethereum blockchain, which is well-known for its stringent security measures. There is no single point of failure on either the Ethereum or Chainlink oracle networks, which reduces the chance of network-wide errors. Despite various additional potential risks involved with Chainlink staking, such as market volatility, and liquidity difficulties. Also a new regulatory implementations, LINK staking can be secure if holders remain vigilant and adhere to safe trading practices.