Annual percentage yield (APY) in crypto measures the rate of return on investment (ROI) from staking or holding cryptocurrencies. APY is the sum users earn from interest-earning crypto investments in 1 year.

While the annual percentage rate (APR) entails simple interest from a crypto investment, the annual percentage yield indicates the complex compound interest. Complex because using APY, investors earn a new interest from the principal crypto plus prior earned interests (compound interest).

In contrast, investors earn only a fixed rate (%) as interest on the principal each passing year (simple interest) with APR. Hence, investors make more gains with APY than APR.

So, users can stake their coins, carry out yield farming or hold their crypto on platforms that allow them to earn through APY investment methods. As their crypto assets are utilized on the platform yearly, they earn compound interest in the same token as the principal.

Calculating Annual Percentage Yield (APY) in Crypto

To calculate APYs, one must understand compounding frequencies. Depending on the platform, the compound interest can be configured as annual, monthly, weekly or daily. Respectively, these configurations give 1, 12, 52 and 365 total periods in a year.

Where P = principal and n = number of periods

For example, to calculate the APY for a 10,000 BTC investment at a 5% compound interest at weekly compounding for a year. First, convert the 5% to decimal: 0.05, and remember that weekly compounding entails 52 periods. Applying the above formula:

After a year, the investment yields approximately 512.5 BTC APY, and the investor gets 10,512.5 BTC. If extended by another year:

The investor gets 538.7 BTC APY in the second year, and 10512.5 plus 538.7 totals 11051.2 BTC.

Calculating APY for More Than 1 Year

Where P = principal, n = number of periods and X = number of years

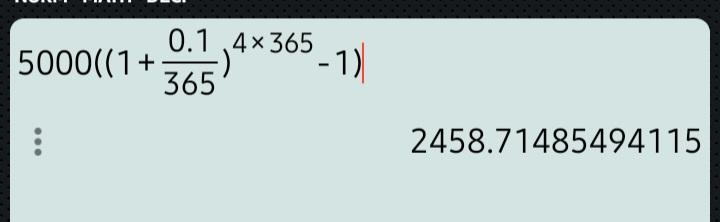

For example, to calculate the APY for a 5000 ETH investment at 10% compound interest daily compounding for four years. First, convert the interest rate (10%) to decimal format: 0.1 and state that daily compounding entails 365 periods. Applying the formula:

So, the investor gains 2458.7 ETH as APY after four years. In the end, he has 5000 plus 2458.7 equals 7458.7ETH.